22/03/2024

The real-world applications of artificial intelligence (AI) and machine learning (ML) have been a game-changer for the finance sector, though changes are coming incrementally. While banks and financial institutions are rapidly adopting generative AI, which, among other things, promises earnings growth and better decision-making, it also comes with new risks that need to be managed.

In this article, we will explore AI in the context of the finance industry. While it has a lot of potential, it’s essential to be mindful of the risks that exist, particularly the burgeoning fraud risk that is posing a more significant challenge with each passing day. As AI accelerates, so too do the tactics of threat actors aiming to exploit financial systems, making the battle against fraud an ever-evolving front.

A brief overview of AI in finance industry

The adoption of AI within the financial services sector has seen significant growth, with Predictive AI becoming increasingly prevalent while generative AI is just beginning to make its mark.

Despite initial hesitations, the capabilities of generative AI are now drawing interest, with financial institutions looking to harness its potential in conjunction with predictive AI. As advancements in risk management continue, the adoption of generative AI is anticipated to accelerate, positioning it as a formidable competitive edge in the finance industry.

The journey towards broader implementation of generative AI in financial services is not without its hurdles. These challenges range from technical constraints and the necessity of establishing a robust innovation foundation to the critical task of recruiting a workforce with the requisite skills. One of the most pressing concerns for firms is ensuring that their use of generative AI aligns with existing legal frameworks, a task complicated by the evolving landscape of AI regulation. The unpredictability surrounding future regulatory directions adds another layer of complexity, necessitating a forward-thinking and adaptable approach from financial institutions.

Currently, the financial sector is in the nascent stages of generative AI adoption. However, this early phase is pregnant with the potential for mass integration across key operational functions. This unfolding scenario presents a golden opportunity for forward-looking firms to harness generative AI, not merely as a tool for innovation but as a strategic lever to carve out a competitive edge. The institutions that navigate these initial challenges effectively, embracing the transformative potential of generative AI while adeptly managing regulatory compliance and technical hurdles, stand to benefit as the financial services industry continues to innovate and transform.

AI’s potential in the finance sector

Process automation

Integrating AI within the finance and insurance industries has led to many considerable improvements in operational efficiency. This is achieved primarily by automating repetitive and time-consuming tasks such as data entry, document processing, and handling routine customer inquiries. Modern solutions can stream these processes with remarkable accuracy and speed, and they’re getting better daily.

By relegating mundane tasks to AI, companies can mitigate the risk of human error and redeploy their human resources to focus on more strategic and complex issues, fostering innovation and enhancing job satisfaction among employees who can now engage in more meaningful work.

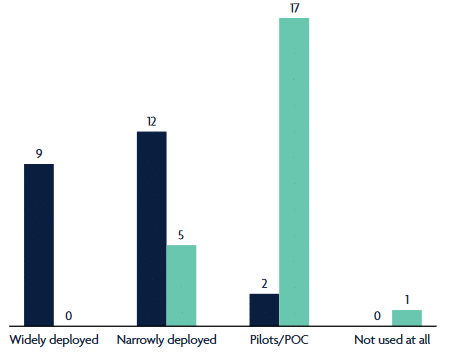

In a recent survey, 23 financial institutions in the UK were asked, “Which best describes your current AI usage at your institution?”

Risk assessment and management

For obvious reasons, being able to assess risk quickly and accurately is critical in finance. AI algorithms stand out through their capacity to digest and analyse vast datasets far beyond human capabilities, identify risk factors for insurance policies, and pinpoint promising investment opportunities.

This raw analytical power of some AI solutions enables companies to make decisions that are not only faster but also grounded in a more comprehensive understanding of risk exposure. Consequently, AI’s role in risk assessment is reinventing how companies approach their strategic planning and risk management, leading to more resilient and informed business practices.

Fraud detection

The financial sector has historically been the target of threat actors. With the widespread adoption of technology among consumers and businesses alike increasing the attack surface and making it easier for criminals to commit financial crimes, firms have a need to implement robust safeguards to prevent financial losses and protect customer data. AI’s ability to detect fraudulent activities in real time is one reason why it has taken off in the financial sector.

By scrutinising transaction patterns and identifying anomalies, AI systems can flag potential fraud with a precision that traditional methods struggle to achieve. This proactive approach not only reduces the potential for significant financial losses but also reinforces customer trust—they’re reassured in knowing that their financial providers are using cutting-edge technology to secure their assets and personal information.

Personalised customer experience

AI-powered chatbots and virtual assistants are redefining customer service in the finance sector. By delivering personalised recommendations, answering queries, and assisting with account management, these AI interfaces create a customer experience that is both seamless and engaging.

This personalised interaction enhances customer satisfaction and fosters loyalty, as customers appreciate the convenience and tailored service that AI can provide. At a time when customers are continuously expecting more, AI is becoming a critical, must-have tool for delivering exceptional service.

That said, there are some limitations. According to Forbes, the average financial service chatbot can only handle straightforward account servicing questions. It struggles to explain financial concepts, cannot assist with financial planning, and does not provide advice or help with investing.

“The industry’s chatbots are primarily designed to handle relatively straightforward customer support needs and are not advanced enough to serve as a true assistant or advisor.”

This is one area where generative AI could make a big difference in financial services. Generative AI assistants can answer a wide range of queries accurately, explain financial concepts, and provide high-level advice when prompted correctly.

Predictive analytics

AI’s ability to perform predictive analytics by sifting through historical data offers finance and insurance companies a powerful tool to forecast future trends. Whether predicting shifts in financial markets or anticipating insurance claims, AI enables companies to transition from reactive to proactive strategies.

This foresight can lead to more informed decision-making, thereby optimising strategies to leverage upcoming opportunities or mitigate potential risks. Predictive analytics, therefore, sharpens a company’s competitive edge and contributes to more stable and predictive business outcomes.

Compliance monitoring

Regulatory regimes are changing rapidly in response to the challenges posed by the development of technology and AI and the rise in criminality that it has enabled. Financial institutions must ensure that they’re ready to comply with new laws and regulations or risk hefty fines and reputational damage.

By alerting compliance officers to discrepancies, AI can help firms maintain a stringent compliance posture. This automated monitoring ensures that companies stay on the right side of current laws and regulatory requirements and reduces the workload on compliance teams, allowing them to concentrate on more strategic compliance issues.

Furthermore, generative AI can be programmed to continuously scan for and interpret new or amended regulatory guidelines across jurisdictions. It can then generate summaries or detailed reports on how these changes impact different aspects of a financial institution’s operations, ensuring that compliance teams are always aware of the latest requirements and can adjust their strategies accordingly.

Investment management

So-called AI-powered robotic advisors might sound like something out of a sci-fi film. Still, they’re real, and they’re making investment management available to a broader audience as generative AI continues to take hold.

By providing automated, personalised investment advice based on an individual’s risk profile and financial goals, these AI-powered advisors have opened the door to investing for those who may have found traditional avenues too daunting or expensive.

This AI-driven approach not only simplifies the investment process but also tailors it to meet the unique needs of each investor, potentially leading to more diversified and balanced portfolios across a more comprehensive section of the population.

AI’s growing role in fraud detection and prevention

Fraud detection and prevention have always been a cornerstone of risk management in finance and insurance. As we mentioned earlier, just as the growth of AI has prevented a myriad of new challenges and threats for firms, it’s also led to a shift in how they approach it, moving away from traditional, often reactive methods to a more dynamic, proactive stance.

AI’s capacity to sift through and analyse large volumes of data in real-time has equipped firms with a powerful tool to detect suspicious patterns and anomalies indicative of fraudulent activities. Here’s how it does this.

Anomaly detection

AI algorithms are adept at sifting through historical transaction data to identify established behaviour patterns for individuals or entities. These patterns are a benchmark against which any deviation can be scrutinised for potential fraud. For instance, a transaction significantly more significant than a user’s average spending or one originating from a geographically unusual location can be flagged.

This capability hinges on the AI’s deep learning algorithms, which, through vast amounts of data, learn to discern between benign anomalies and those indicative of fraud, thereby reducing false positives and focusing investigative resources more effectively.

Machine learning models

Fraud detection AI is, at its core, based on machine learning models trained on datasets of known fraudulent and non-fraudulent activities. These models, which utilise techniques such as classification, clustering, and anomaly detection, continuously evolve by learning from new data.

This ability to continuously adapt and improve makes machine learning models increasingly proficient at identifying even the most subtle fraud indicators. This helps ensure that financial institutions stay one step ahead of fraudsters who constantly switch up their tactics.

Natural language processing

Natural language processing (NLP) enables AI systems to parse and understand text data with great nuance, from customer emails and chat logs to social media posts. Techniques like sentiment analysis and keyword extraction can unveil the intent behind communications, spotting potential fraud through the detection of suspicious language patterns or the discussion of specific topics known to be associated with fraudulent activities. This analysis extends AI’s detection capabilities beyond numerical data, offering a comprehensive view of potential fraud indicators.

Network analysis

AI’s ability to analyse complex networks and relationships between entities can reveal hidden connections that might indicate fraudulent schemes, such as money laundering or collusion. By mapping out these networks, AI can uncover patterns of behaviour that are characteristic of organised fraud, enabling institutions to dismantle entire fraud rings rather than just catching individual perpetrators.

Real-time monitoring

Real-time monitoring is perhaps one of the most important developments in modern fraud detection. AI-powered systems can scrutinise every single transaction as they happen and compare them against known fraud indicators and learned patterns of normal behaviour. This immediacy enables financial institutions to catch fraud in the act, dramatically reducing the window of opportunity for criminals and the potential for financial loss.

Examples of real-time monitoring in action include:

- Transaction analysis: AI systems scrutinise every transaction in real time, comparing them against established standard behaviour patterns. Any transaction that deviates significantly from these patterns—for example, an unusually large transfer or a payment to a new, unverified account—is flagged for further review. This immediate response helps prevent fraudulent transactions before they are completed.

- Location-based anomalies: By integrating geolocation data, AI can detect when a card or account is being used in a location that doesn’t match the user’s known patterns or current physical location, as indicated by their mobile device. Such discrepancies can trigger real-time alerts to the institution and the customer, potentially stopping fraud.

- Biometric verification: In the context of mobile banking or payment apps, AI-powered systems can monitor biometric inputs such as fingerprints, facial recognition, or voice commands in real time. If the system detects anomalies in the biometric data, it can immediately block transactions and prompt additional verification, adding an extra layer of security.

Behavioural biometrics

Beyond traditional biometric measures, AI explores behavioural biometrics, analysing patterns in how users interact with their devices. This includes typing rhythms, mouse movements, and browsing behaviours, creating a profile so unique that any deviation might signal account compromise or identity theft. This sophisticated form of detection adds another layer of security, making unauthorised access increasingly difficult.

Examples of behavioural biometrics include:

- Keystroke dynamics: This involves analysing how a user types on a keyboard, including the rhythm and timing between key presses and releases. AI can detect inconsistencies in typing patterns that may suggest a different user, potentially indicating account takeover or unauthorised access attempts.

- Swipe patterns and touch dynamics: On touchscreen devices, swipe patterns, the amount of pressure applied, and the speed of touch interactions can serve as unique identifiers. AI systems can analyse these patterns for signs of anomalous behaviour, useful in mobile banking and payment applications to prevent unauthorised access.

- Navigation and browsing behaviour: Examining how users navigate through apps or websites, including page visit sequences, interaction with forms, and time spent on pages, can also serve as behavioural biometrics. AI can detect deviations from established patterns, suggesting that a different user may be attempting to commit fraud.

Integrations with fraud databases

Finally, the integration of AI systems with external fraud databases enhances their ability to screen transactions and identities against comprehensive lists of known fraudsters, stolen identities, and blacklisted entities. This cross-referencing is crucial for quickly identifying and stopping transactions that pose a high risk of fraud.

Our partner OneReach.ai calls this function the ‘Fraud Alert’ and can be programmed to provide real-time alerts when suspicious activity is detected. This makes it easier for compliance teams to meet their obligations in detecting potential fraud instances and filing timely reports to regulators. In the EU, for example, regulated firms must file a Suspicious Activity Report when there is knowledge, suspicion, or grounds to believe that money laundering or terrorist financing is occurring.

Reinventing finance and insurance

AI has become indispensable in the finance and insurance sectors’ ongoing battle against fraud, significantly enhancing their capability to detect and prevent fraudulent activities. Through its capacity to automate and refine documentation processes, reduce physical document loads, and deploy advanced fraud detection techniques, AI sets the stage for a new era in financial operations—one where efficiency and security are significantly enhanced.

However, it’s the implementation of advanced analytics tools where AI has the most significant impact. This empowers companies to sift through vast transaction data in real-time to identify suspicious patterns and anomalies deviating from established norms. This capability is critical for identifying potential instances of fraud and enables the immediate flagging of unusual activities to meet compliance and regulatory requirements.

Furthermore, AI’s predictive modelling techniques equip companies with the foresight to anticipate fraudulent schemes before they materialise, thus providing an invaluable tool in safeguarding assets maintaining customer trust and maintaining a robust defence posture against the growing attack surface and sophistication of fraud attempts.